By Marilyn Odendahl

The Indiana Citizen

November 26, 2025

A toothache may seem minor compared to the other medical conditions and accidents that can send people to the hospital, but the number of Americans seeking treatment in emergency rooms for nontraumatic dental conditions, and the costs associated with the care, have been increasing, making dental debt a growing concern.

To better understand how dental debt is impacting Hoosiers, the Indiana Community Action Poverty Institute is partnering with CareQuest Institute for Oral Health to study what has been called a crisis. The two nonprofits will research debt arising from dental care and how individuals and families in Indiana are coping with the unpaid bills.

Medical debt caused by a dental procedure or emergency remains understudied, even though more than 1 in 4 Hoosiers lacks dental insurance, according to CareQuest.

“We are excited to have this new partnership with the CareQuest Institute for Oral Health to engage in research and educational efforts to better inform decision makers and the public on the burden of dental medical debt for Hoosiers,” Lauren Murfree, policy analyst at the Indiana Community Action Poverty Institute, said in a press release. “This support will allow us to talk with Hoosiers directly impacted by the current unaffordability and accessibility of dental care in our state and aligns with our efforts to reduce the financial pressures Hoosiers feel due to medical debt.”

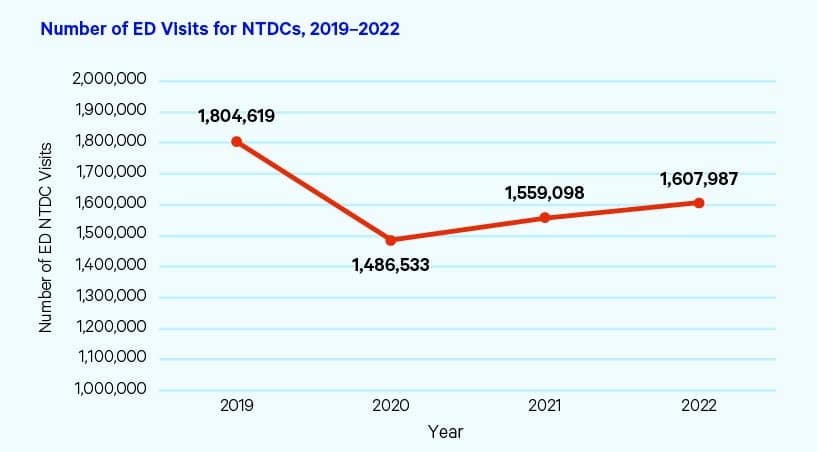

CareQuest has found that nationally the number of individuals seeking treatment for a nontraumatic dental condition in an emergency room dropped after reaching 1.81 million in 2019, but has since climbed to 1.61 million in 2022, the most recent data available.

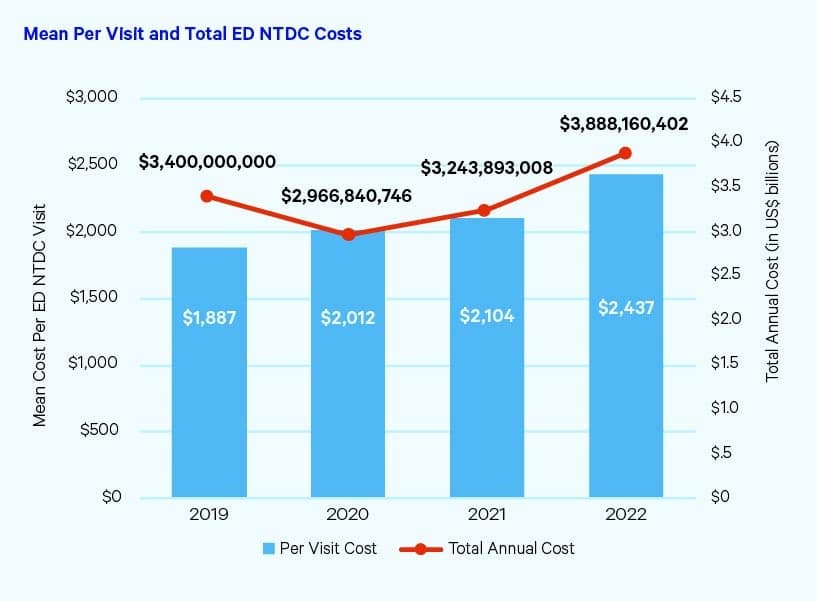

The cost for treatment has also been rising, CareQuest reported. In 2022, the estimated total costs for emergency room visits for nontraumatic dental conditions hit $3.89 billion, up from $3.40 billion in 2019.

An oral health dashboard created by CareQuest shows Indiana is close to the national average in terms of dental insurance coverage and conditions. Among Hoosier adults, 26.4% do not have dental insurance, while the national average is 26.0%. Also, 13.6% of the adults in Indiana have unmet dental needs, compared with the national average of 13.0%, and 26.8% of adults in Indiana have out-of-pocket dental care costs greater than $500, compared with the national average of 26.9%.

“Oral health comes at significant financial cost, yet ties into well-being as dental issues often carry stigma and result in social exclusion,” Zia Saylor, researcher at the Indiana Community Action Poverty Institute, said in a press release. “Understanding experiences of dental debt and barriers to oral healthcare is a critical way to advance policies that would ultimately improve the well-being of our communities.”

Research shows the cost of dental care in an emergency room is not exorbitant but can be enough to break a household budget.

According to CareQuest, the mean cost of a visit to the emergency room for a dental problem has jumped 29% from $1,887 in 2019 to $2,437 in 2022.

A 2022 report by the Kaiser Family Foundation found 41% of adults had some debt caused by medical or dental bills. Of those, 56% owed less than $2,500.

While 59% of adults with medical debt think they will pay it off within two years, according to the Kaiser study, 18% say they do not believe they will ever pay it off. In particular, 24% of Black adults, 26% of adults with household incomes under $40,000, and 25% of uninsured adults doubt they will ever satisfy their health-care debt.

To cover their medical debt, 63% of adults said they had to cut back spending on food, clothing and basic household items, according to Kaiser. Some took more desperate measures with 48% depleting all or most of their savings, 40% taking a second job or working more hours, and 37% skipping payment on other bills. For others, the health-care debt directly impacted their housing with 28% delaying buying a home and 19% changing their living situation, including by moving in with family or friends.

The Indiana Community Action Poverty Institute plans to begin advocacy activities early in the new year and plans to release its research report on dental debt in the fall of 2026. Interested individuals are encouraged to reach out to institute@incap.org to share their stories and desires for legislative engagement on the matter.

“As someone who has personally dealt with various forms of medical debt – including dental – I am acutely aware of the need for efforts to improve our current reality,” Murfree said in a press release. “I look forward to engaging with fellow Hoosiers to better educate decision makers on the impact of dental debt on wellbeing and advocate for ways to ensure dental care needs do not place Hoosiers into financial distress.”

Dwight Adams, an editor and writer based in Indianapolis, edited this article. He is a former content editor, copy editor and digital producer at The Indianapolis Star and IndyStar.com, and worked as a planner for other newspapers, including the Louisville Courier Journal.

The Indiana Citizen is a nonpartisan, nonprofit platform dedicated to increasing the number of informed and engaged Hoosier citizens. We are operated by the Indiana Citizen Education Foundation, Inc., a 501(c)(3) public charity. For questions about the story, contact Marilyn Odendahl at marilyn.odendahl@indianacitizen.org.