By Marilyn Odendahl

The Indiana Citizen

May 24, 2024

In its fight against housing discrimination, the Fair Housing Center of Central Indiana believes knowledge is power.

The nonprofit based in Indianapolis has launched an online fair housing data portal which provides demographic stats and mortgage lending metrics for the Indianapolis metropolitan area. In particular, individuals accessing the site can review a list of the top mortgage lenders in Central Indiana and see each lender’s stats for approving mortgages by customer race, ethnicity, income and gender.

Amy Nelson, executive director of the Fair Housing Center of Central Indiana, said this information will enable Hoosiers to hold financial institutions accountable for inequitable lending practices. Customers can tell banks and credit unions who rank poorly on the portal that they expect improvements or they will take their business elsewhere. Also, anytime these lenders are out in the community and at an event, people can talk to them about unfair lending practices and ask them what they are doing to correct the problem.

“That is valuable for us here at the Fair Housing Center, because, very often, it is just the Fair Housing Center going head to head with these low performing lenders,” Nelson said. “By us knowing that the public is also part of that, the public is also saying, ‘Look, I’m like, I’ll take my business elsewhere,’ or ‘I may not bring my business to you, unless you do better,’ that can be incredibly impactful for us in getting needed change.”

The Fair Housing Center, which opened in Indianapolis in 2012, has led advocacy efforts alleging that public housing agencies, landlords, property management companies and lending institutions have discriminated against minorities, people with disabilities and families with children.

FHCCI has either filed or joined enforcement actions against such institutions as Wells Fargo, U.S. Bank, Fannie Mae, Citywide Home Loans, Pierce Appraisal, Deutsche Bank, Ocwen Financial and Altisource, alleging a range of violations including failure to market and maintain foreclosed homes in minority neighborhoods and discrimination based on race and color in the appraisal and mortgage lending process.

Many times the parties have reached settlements with lenders who agreed to change their practices. For example, in a 2019 settlement, First Merchants Bank announced several new initiatives designed to increase mortgage lending to majority-Black neighborhoods and census tracts in Marion County, including opening a new branch in an underserved neighborhood, appropriating $1.12 million in loan subsidies, originating $4 million in loans for the development of new multifamily housing in majority-Black census tracts, and giving $150,000 to support a fair lending education and literacy program.

The Fair Housing Center relies heavily on the kind of data included in the new portal as part of its advocacy and enforcement work. Also, it incorporates statistics and analysis in its reports about housing and mortgage lending in Central Indiana.

The popularity of those reports, which have been downloaded thousands of times, Nelson said, along with people’s interest in the FHCCI’s investigations spurred the nonprofit to create the housing portal to make more information available to the public.

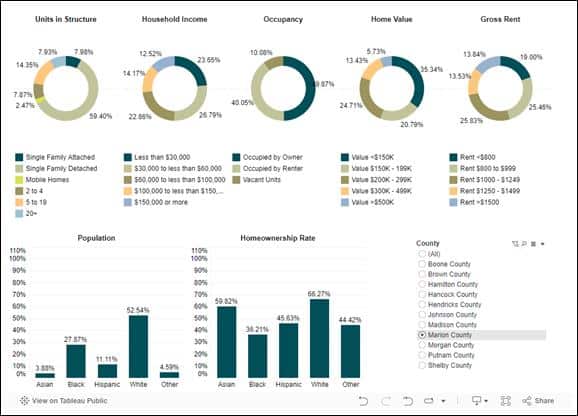

Currently, the portal is drawing public data from the U.S. Census and from the lending information financial institutions are required to report under the Home Mortgage Disclosure Act. Focused on the nine central Indiana counties that comprise the Indianapolis metropolitan area, the demographic data includes population, homeownership rates, average household income and occupancy stats for each county. The mortgage lending information lists the top lenders by county and provides data on each lender’s mortgage application, origination and denial rates.

Nelson said a lot of careful thought went into designing the portal, so it can be used by “individuals who might like to see things more visually and individuals who might like to see the numbers and really drill down” into the data. Going forward, she said, the FHCCI plans to make more information available in the portal and expand the number of counties covered.

Housing in Indiana, Nelson said, is a difficult topic to understand. Many Hoosiers, she said, do not know the history and the continuing discriminatory practices that have created segregated neighborhoods and placed barriers on people of color seeking to buy a home. The portal and the traveling “Unwelcomed” exhibit are part of the work the FHCCI is doing to educate people and encourage them to take action.

“If they want to learn about something, we want that to be available to them and they not be kept in the dark, so that they can see the lending challenges that are still present,” Nelson said. “They can do searches, and rank high- versus low-performance lenders in different categories, and, again, help us in holding them accountable to do better in our community.”

Dwight Adams, a freelance editor and writer based in Indianapolis, edited this article. He is a former content editor, copy editor and digital producer at The Indianapolis Star and IndyStar.com, and worked as a planner for other newspapers, including the Louisville Courier Journal.

The Indiana Citizen is a nonpartisan, nonprofit platform dedicated to increasing the number of informed and engaged Hoosier citizens. We are operated by the Indiana Citizen Education Foundation, Inc., a 501(c)(3) public charity. For questions about the story, contact Marilyn Odendahl at marilyn.odendahl@indianacitizen.org